Alfredo Paramico Manager of Passion Investment Fund

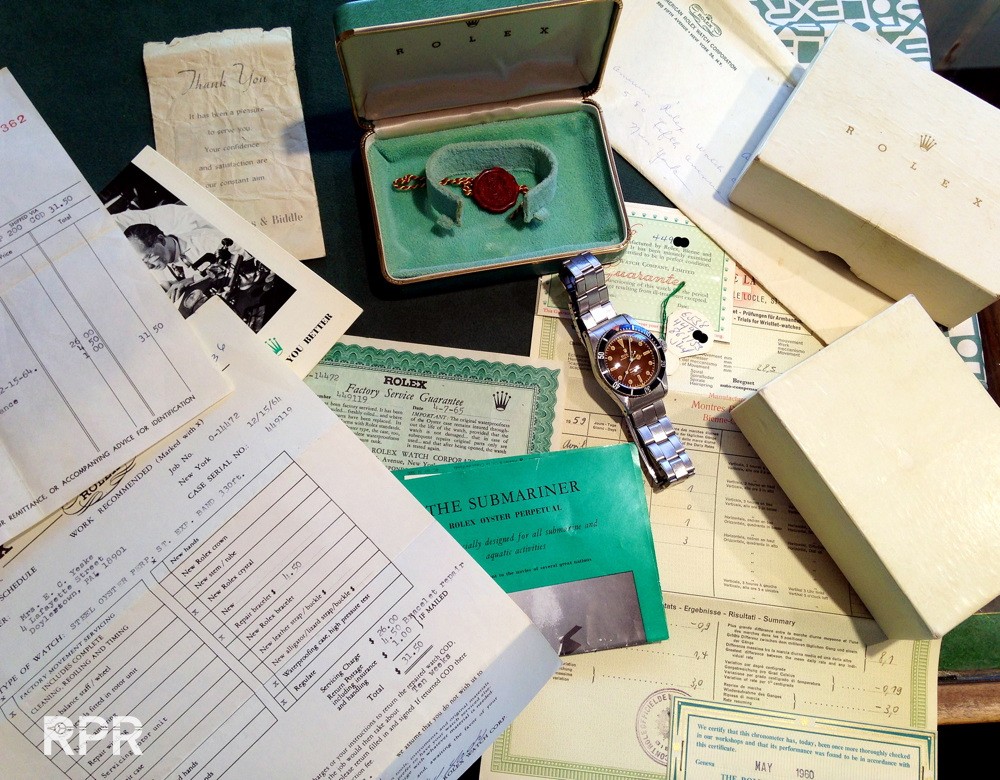

I got the end of March Performance email where we can read about Mr. Paramico’s market view and experiences. For your interest, here are some quote’s about recent quarter market comment, strategy of second quarter, a portfolio analyse and display of new purchases. This give you a quick understanding from what’s going on. I read Alfredo also thinks Geneva will be wild on PPC’s, I think for top & rarest quailty, there’s no estimate. More are interested to buy but less is coming to the market, next logic is rocket prizing. Besides the top examples, we see many collectors act on top condition and 100 % originality has become the keyword to buy any Rolex or Patek Philippe reference and the ‘game’ for some out there to hunt them down by selling their sport collection and getting themselves lost with colorful DayDates, or early old gold Oyster Chronographs. These trends will set a new prices level for those that are until now still under valued. So it’s not only about the best in $$, passion of collecting vintage watches has become finding the best possible condition. You can do this for 5-10K or when you like and are able to, for 5-10 Million a year. The game will be the same, first condition, then originality, then rarity, provenance and likeability, add fashion and personal tatste. Follow these guidelines and you’ve lots of fun & a very profitable collection at the end! 😉

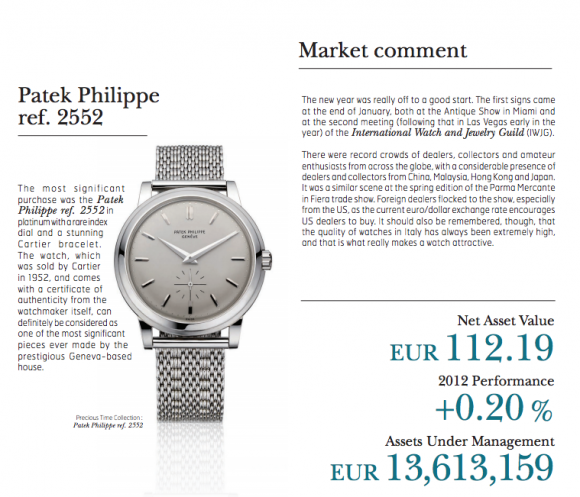

Market Comment of last quarter..

Or go directly to Elite Advistors and check out all their info on: http://www.eliteadvisers.com

Strategy: “We are riding the wave of Rolex Sport Watches…” Why consider buying the collection? Do it! 😉

Slowly the market understands how rare good examples in honest conditions are! Within a year top quality of the most sought after grail Rolex will rize at lleast 25 %.

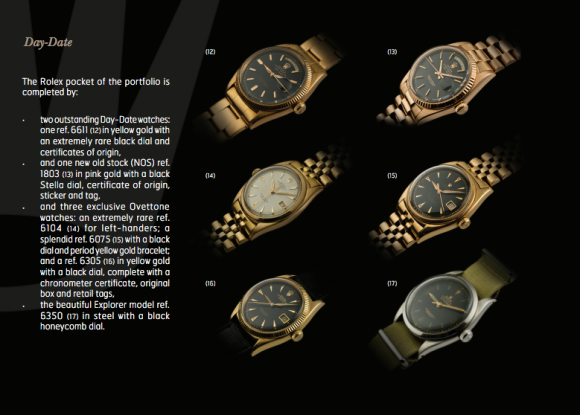

Double with red, both from early 1956 and both unique! Rolex History is getting more valuable while reading this, haha! 😉

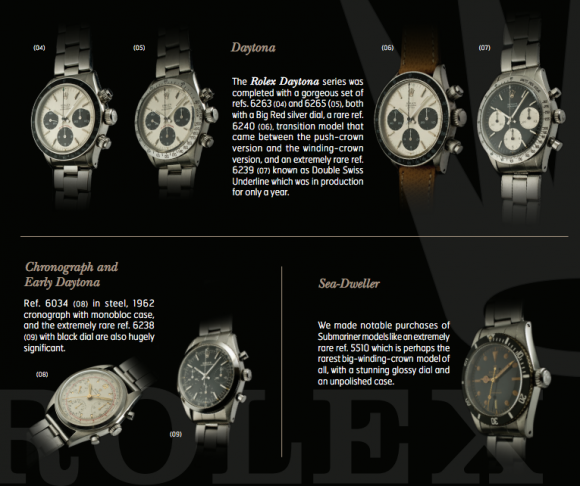

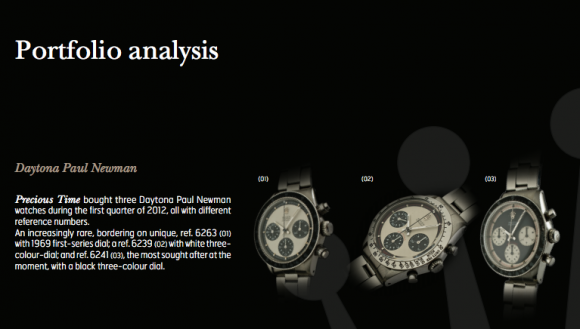

Another save bet… My handfull of special Daytona’s… 😉