Vintage watch value growth: Tulip Mania or steady buying frenzy?

During the famous 17th century Dutch Golden Age, phenomenally high prices were paid for tulip bulbs until the market suddenly crashed. This period of extreme speculation called Tulip Mania, is generally seen as the world’s first economic bubble. Some vintage watch market followers are starting to compare this historic bulb trading business with the current extreme growth of vintage watch prices.

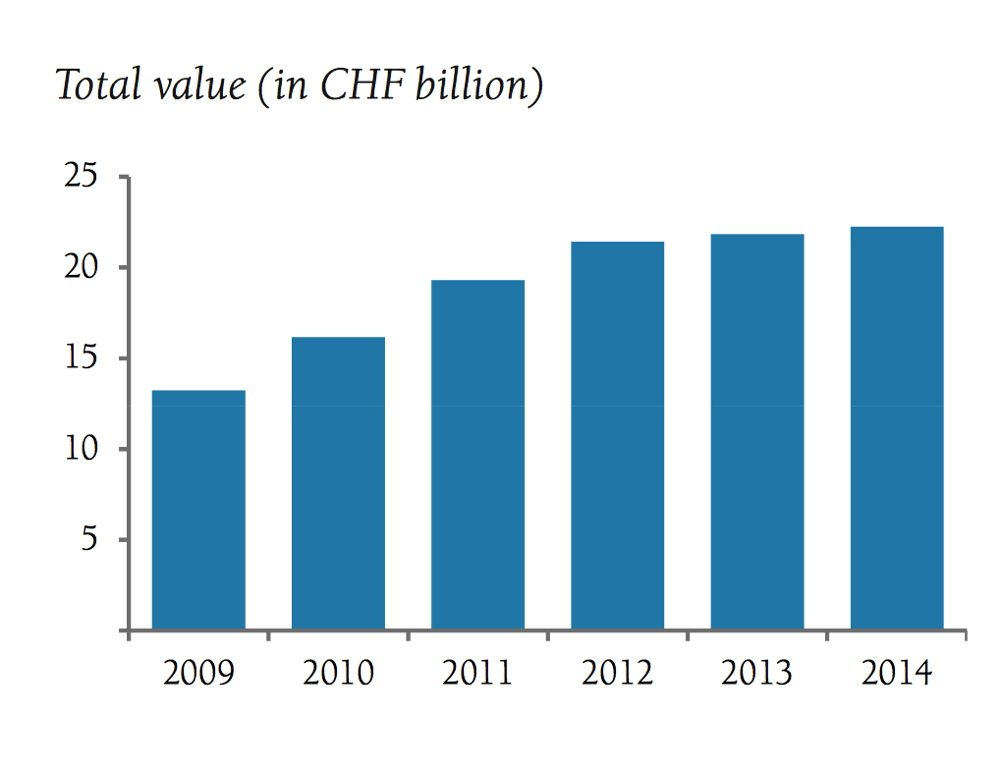

The sales of modern watches has known a period of boom over the last twenty years. Last year the total sales volume accumulated to a whopping $22 billion! There is however a difference with the tulip speculation era. Buyers on the current vintage market trade with private money, no buying on the tick like tulips.

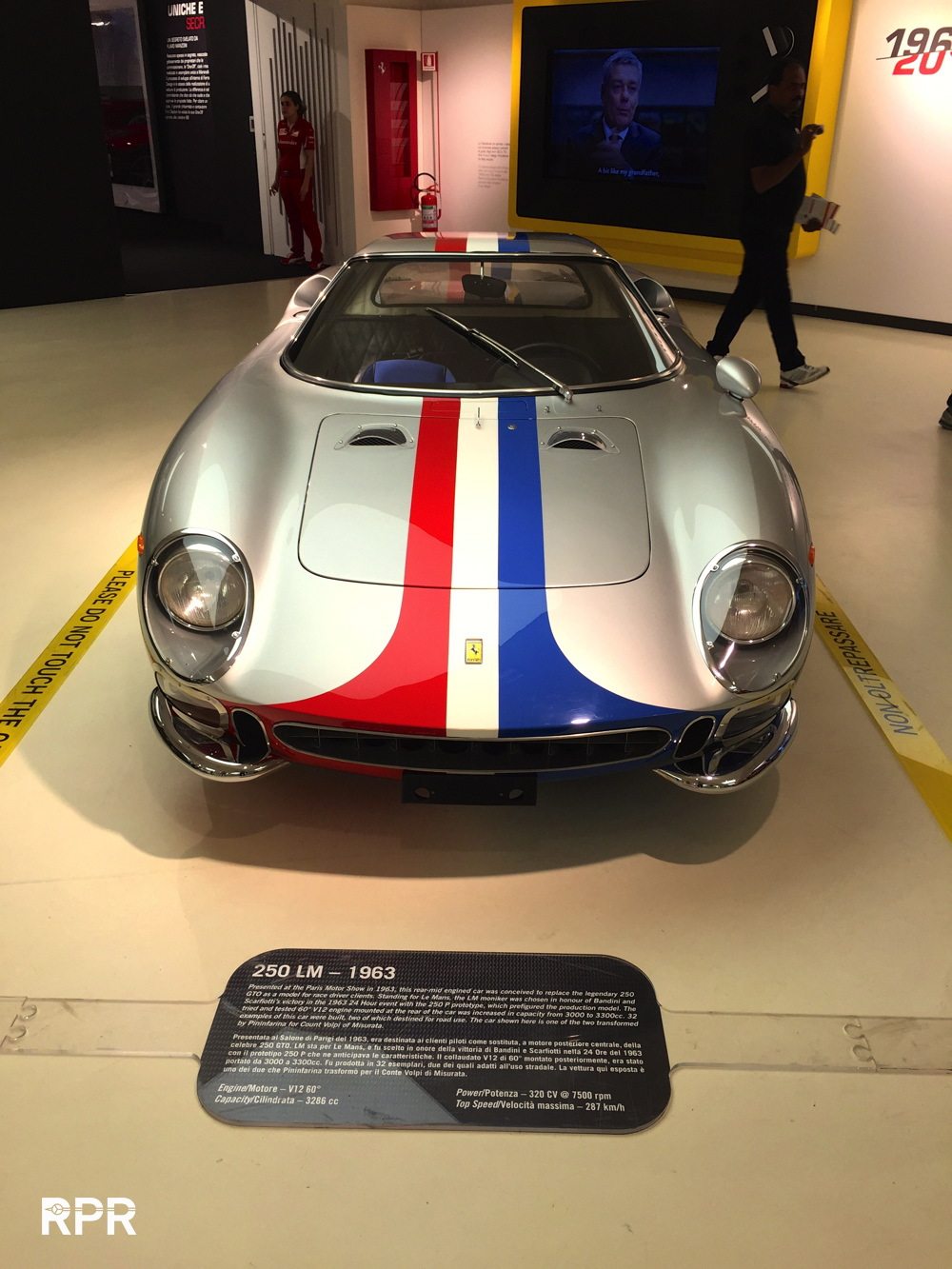

I’d rather like to compare vintage watches with rare art, or better yet classic cars, as there are still brands from the past existing today. If there would be no more Van Gogh, Rembrandt, Ferrari or Bugatti for sale, collectors and dealers would certainly look for new objects. Due to the market’s popularity, this will also attract new collectors. They will most likely operate with more modest budgets and will go for examples just below top quality, pushing these prices as well. A trend you can already see with brands like Longines, Eberhard and Universal. So, instead of a true mania, this market segmentation stabilizes overall demand and pushes the prices for top quality even further.

I’d rather like to compare vintage watches with rare art, or better yet classic cars, as there are still brands from the past existing today. If there would be no more Van Gogh, Rembrandt, Ferrari or Bugatti for sale, collectors and dealers would certainly look for new objects. Due to the market’s popularity, this will also attract new collectors. They will most likely operate with more modest budgets and will go for examples just below top quality, pushing these prices as well. A trend you can already see with brands like Longines, Eberhard and Universal. So, instead of a true mania, this market segmentation stabilizes overall demand and pushes the prices for top quality even further.

Maserati Bora vs Rolex Paul Newman..

For an outsider, this might look like the Tulip Mania scenario while, in fact, the opposite is true. Behind the scenes, top collectors pay top prices but this info never reaches the public. Whenever you see an auction house boasting about record prices, a particular vintage watch has already switched owner long before. In other words, auction houses will not put very rare watches up for sale unless they have already secured a buyer. The publicity and money are so important for a house’s reputation, that the whole bidding process is actually staged and nothing is left to coincidence.

Currently, it can take six months from the announcement until the actual auction of a rare watch, accompanied by a world tour displaying the example to the public. Quite a contrast to the past, with an auction every first Monday of the month, preceded by a viewing opportunity the week before. Today, shareholders rule at auction houses and this puts pressure on the market to perform, which is not easy with hardly any new quality examples coming into play.

Money in the bank used to be worthwhile, but current low return rates force people to invest in other, more lucrative businesses. This is definitely one of the reasons collectibles keep on rising in value. Another trend is a sort of re-evaluation of iconic design. Transparency due to internet and its powerful impact through online forums and social media like Instagram, made many collectors realise that of the finest and most iconic designs in their field of interest only few examples have been made. With the collapse of the hyped collector markets in the 1990s, we now see that it took over twenty five years for people to understand you need step in early, instead of risking to miss out. A feeling fed by an increasing top layer of very wealthy people, more Asian buyers joining the collector’s markets and even banks participating through art and classic car investment funds.

Collecting vintage objects is not only fashionable and a true passion for many collectors, it has become an attractive investment opportunity. Mies van der Rohe’s Barcelona chair, a Ferrari 250 GTO, a Rolex Big Crown Submariner or an Andy Warhol painting, many of these iconic objects are the basis for modern design, produced in large numbers. Take for example the Porsche 911 evolution, a legendary sports car design and model that appeals to almost every man. This enabled Porsche to produce also SUV’s, 4-wheel drive cars and baby 911 models like the Boxter and Cayman.

More than 165,000 of these vehicles were produced in 2013! A figure that certainly doesn’t make Porsche cars rare, but the popular brand from Stuttgart is very good at attracting purist attention by producing limited editions of their most iconic models. Many brands operate this way, turning luxury into mainstream thus making it unsuitable as collection asset or investment object.

I have been involved in the vintage watch world for over 25 years and besides the obvious quest for the rarest and best examples, there have been several other trends. Complicated models were popular in the 1970s and 1980s, because of their limited edition due to the complex production process. The question if a watch was 100% original became more important from the 1990s onwards. The dial had to be authentic and reprints were not accepted anymore. Later on, an unpolished case, owner provenance, service reports, hangtags, boxes, etc. became essential criteria when assessing a watch. Surely, the market has grown up and everything is double checked before any collector is willing to spend considerable amounts of money.

Tropical dials, special issue watches like Military and Comex, mythical red Submariners, big red Daytona’s, single red Seadwellers, just a few Rolex examples from the past that currently fetch high prices. Mr. Pucci’s impressive publications and thematic auctions like Christie’s Daytona & DayDate recently, have really highlighted specific models. The eye for detail and focus on all variations and editions, have pushed the price for a vintage Rolex beyond the historical $1 million mark at auction for the first time ever. As I mentioned before, such high prices have been paid before behind the auction scenes, but are only known to an exclusive group involved. These astronomical amounts are potential life changers for the watch’s seller, but also stir the market to look for logical alternatives.

So, what’s the next big thing in the vintage watch world? It seems obvious that brands with the same dial, case, band or movement suppliers as market leaders Rolex and Patek Philippe will rise in value. The Universal Nina Rindt model is a good example, fitted with an impressive dial produced by Singer, the same manufacturer that designed the Rolex Paul Newman dial. Although the latter easily fetches ten times more than the Nina Rindt, this iconic Universal watch is already worth over $30,000. A remarkable increase, considering the asking price was between $3,000-$5,000 only two years ago. No tulip mania but simple age-old market forces of supply and demand at work.

All over matching patina and perfect condition are more than ever price defining parameters when it comes to collecting vintage watches. And let’s not forget a watch is anonymous and easily portable compared to investing in classic cars or art. That’s why, I wouldn’t be surprised to see another surge in prices at the next Geneva watch auctions in November, attracting even more collectors. Luckily, there is still much to explore for all us vintage lovers to keep us going for many years to come.