Vintage Rolex market predictions for 2016

I personally think that for 2016 the watch market in general is gonna correct the extreme mark-up of some iconic references. The growth of some models have been too extreme over the past 2 years. During this period we have seen that some highly sought after models raised in price so much, it’s unrealistic to keep thinking there will be enough buyers paying this much in the near future. First everybody needs to get used to the new price level we achieved so far before we can make a new jump again. It takes time before we all realize what the effects of this price explosion has been.

Therefore, I think the market has become more discerning, with prices softening a little bit as a result though only back to levels at which vendors will still be sitting on a handsome profit from watches bought in the past 2-3 years. Although many great results have been registered during the past auction season, one would think that the market is only getting up but the real picture is not that simple. We have seen lower estimates and more watches been passed during the sales. The background story for 2016 seems to be one of healthy consolidation.

Since

Phillips Watches came into the market as a mayor player offering „only the best”, one could come to the conclusion that there’s a slight oversupply of so called „grail” watches. Therefor the total number of auctions and the amount of vintage watches for sale increased more then the number of collectors that are in the market. Many new collectors are entering the watch market, mainly due to the hype on Instagram and other social media.

The awareness of having something vintage & authentic has become a true must have. To get an balance again, we still need to educate the market further by explaining how rare for instance a unpolished case is or an untouched dial. Watches of the type you can not buy another one next month, have continued to increase in value. In some cases we really can’t talk about what the correct price is because everything you say shows to be to little.

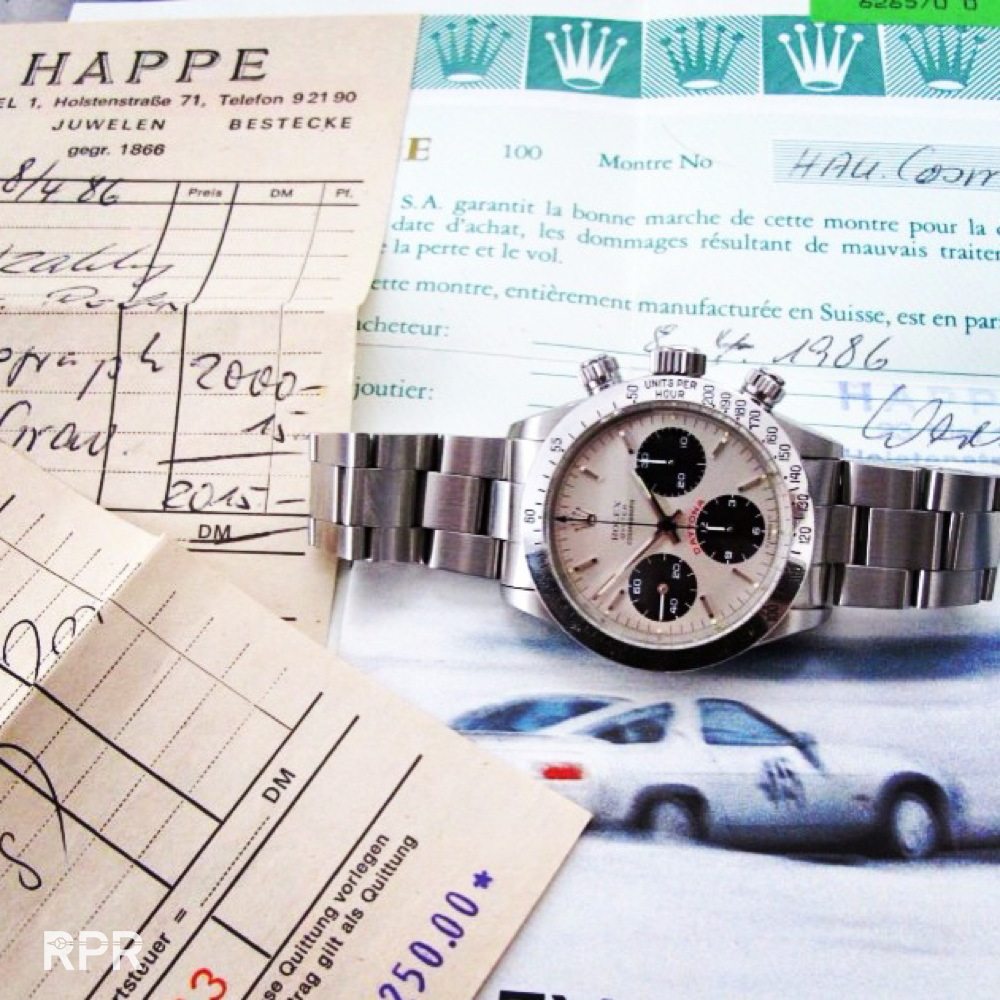

I bet we will see some exceptional rare vintage watches been offered for sale in 2016 and they will bring new record prices. The question is if the rest is also gonna perform well and increase in value compared to 2015. I do believe if the average watch by condition is priced correctly, the current market has become big and mature enough to absurb any quality offered, also for average, the trade or starting collectors will buy it. For example, a regular Rolex Daytona Ref 6263 & 6265’s is reaching € 35/40K and easily more for crisp examples or ones with official paperwork. Not to mention Ref 6240’s for 50-60K+ and gold Daytona’s starting now at 80-100K+. That’s some 30-40% more then like 12- 18 months ago when the dollar was lower compared to the euro.

So what is gonna be trendy and upcoming vintage Rolex wise for 2016?

Consolidate is the game for 2016 so generally I don’t think we will see this year a special reference doing much better then previous years. So far I know there’s no special dedicated auction planned to push awareness. But the international fashion for the “wanna haves” will continue to push prices of the most wanted glossy gilt Sub’s, GMT’s and Daytona’s. Any reference with a bezel insert is still very hot. As I’ve said many times before, no matter the reference, all original condition with matching patina will be a safe bet to buy the coming years. If this is a Precision, Datejust or even a Cellini, once it’s still crisp, it’s worth collecting.

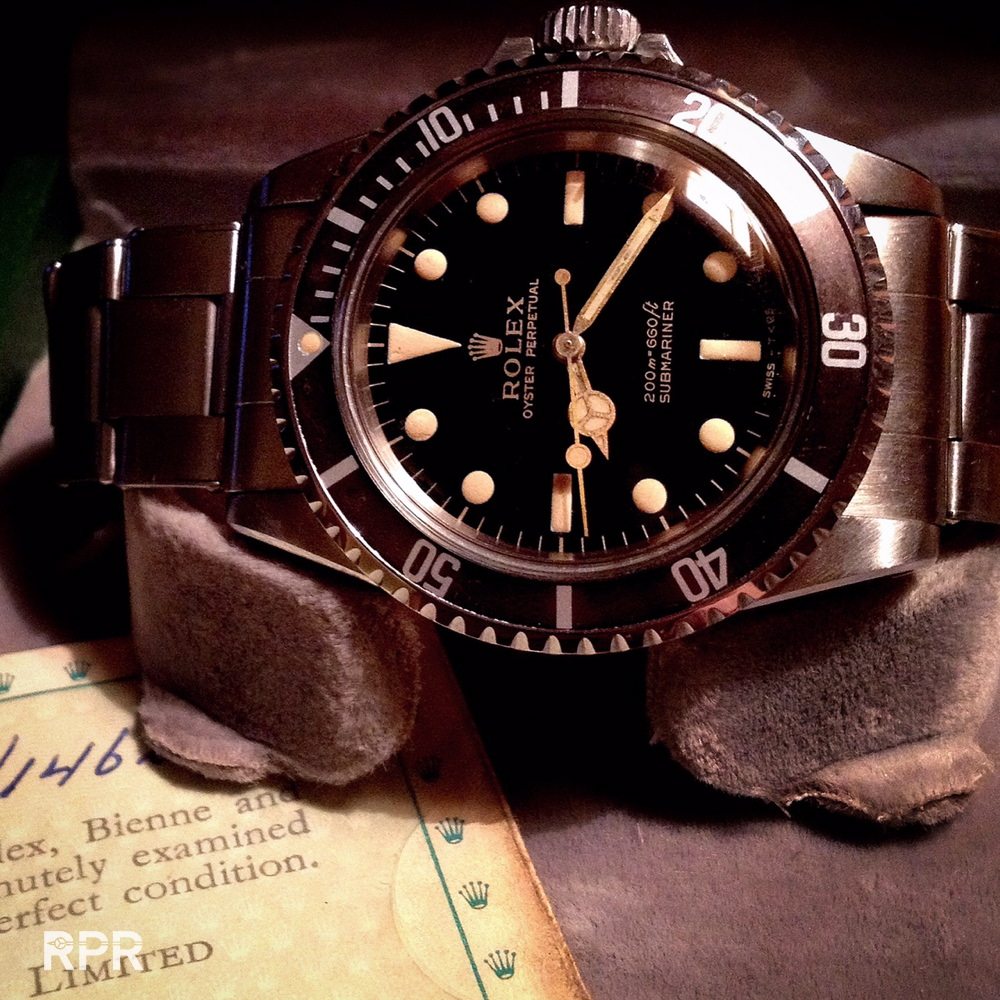

Above, an unpolished Rolex Ref 5513 with glossy dial. Nothing really special by the production numbers is this classic but extremely rare to find in this like NOS (New Old Stock) condition. If you see one, buy it immediately or send me an email 😉 but first make sure

the case is not newly laser welded and then polished to Rolex specification! The bakelite bezeled GMT Master Ref 6542 below is still being undervalued compared to it’s brother, the Submariner. For nice examples with matching radium bezel and dial, that is still glossy, we will see prices go up in 2016 as these already catched up in 2015.

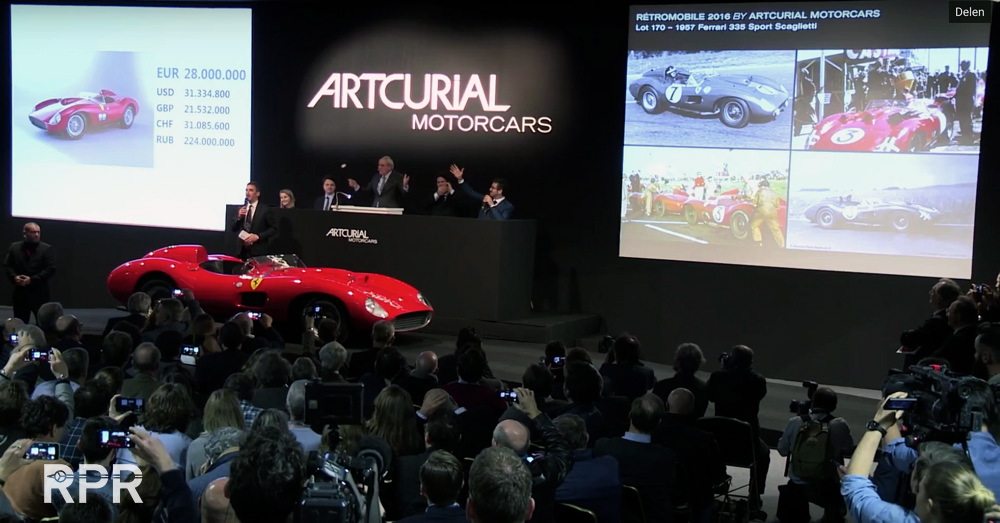

Collecting vintage watches is still relative young compared to other area’s where connoisseurs like to spend their money on. So it’s wise to check what for instance the much bigger volume wise classic car market is doing as their results will reflect the watch business. The first 2 auction meetings, Scottsdale & Paris, are just finished. A great source of information is

Simon Kidston and in particular their market research at K500 website. Experts say that the classic car market is (logically) slowing down after a seven year bull run.

“Everyone is focusing on the pushback in the market, which is of course real and healthy. However we see multiply world record or very strong prices for exceptional cars in many categories.” Generally is being said that the prices are back to early 2014, specially for those fashionable cars where the prices went up so rapidly, the market needs to correct it now. In the classic car market we see that the sellers are to greedy and over asking making it impossible the auction houses sell their car. Hence we see more unsold cars during the last auctions which makes everybody aware that the extreme price increase has to stop, even if it’s just for a while. The collectors market has to understand the differences in quality, if it’s classic cars, vintage watches etc.

- The world record price in euro for the Ferrari 335S sold for hammer € 28 million making it all in € 32.1 million the most expensive car sold at auction in Paris last week.

With watches it’s exactly the same, the iconic references that are being chaised after went up in price considerably. But those that accidentally have been sold at auction for a much higher price then it did before, don’t make a trend. In some cases there’ re just 2 billionaires bidding against each other to surprise the whole auction room with the outcome of their battle. This then isn’t a new price level but merely 2 ego’s that have spoken. Nevertheless dealers tend to up price their stock, even if it is not in the same quality, it’s saver to ask more then loose possible profit. Old trading wisdom says, once you start negotiating, you can always lower your price then sell it immediately regretting you asked to little. Now we’ve come to a point where much sought after references are hardly been found anymore and the most collectors buy to keep and not to trade up later or sell, we need enough watches to make the 2016 auction sales really interesting.

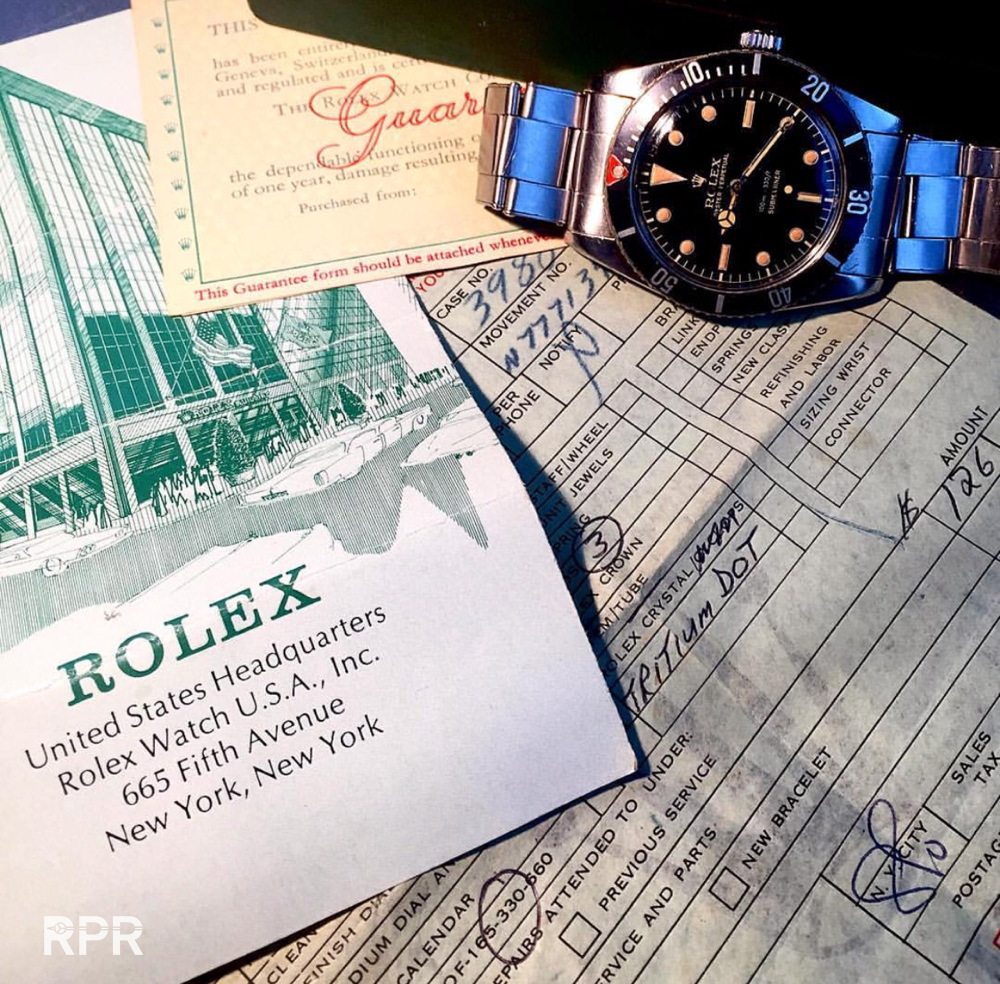

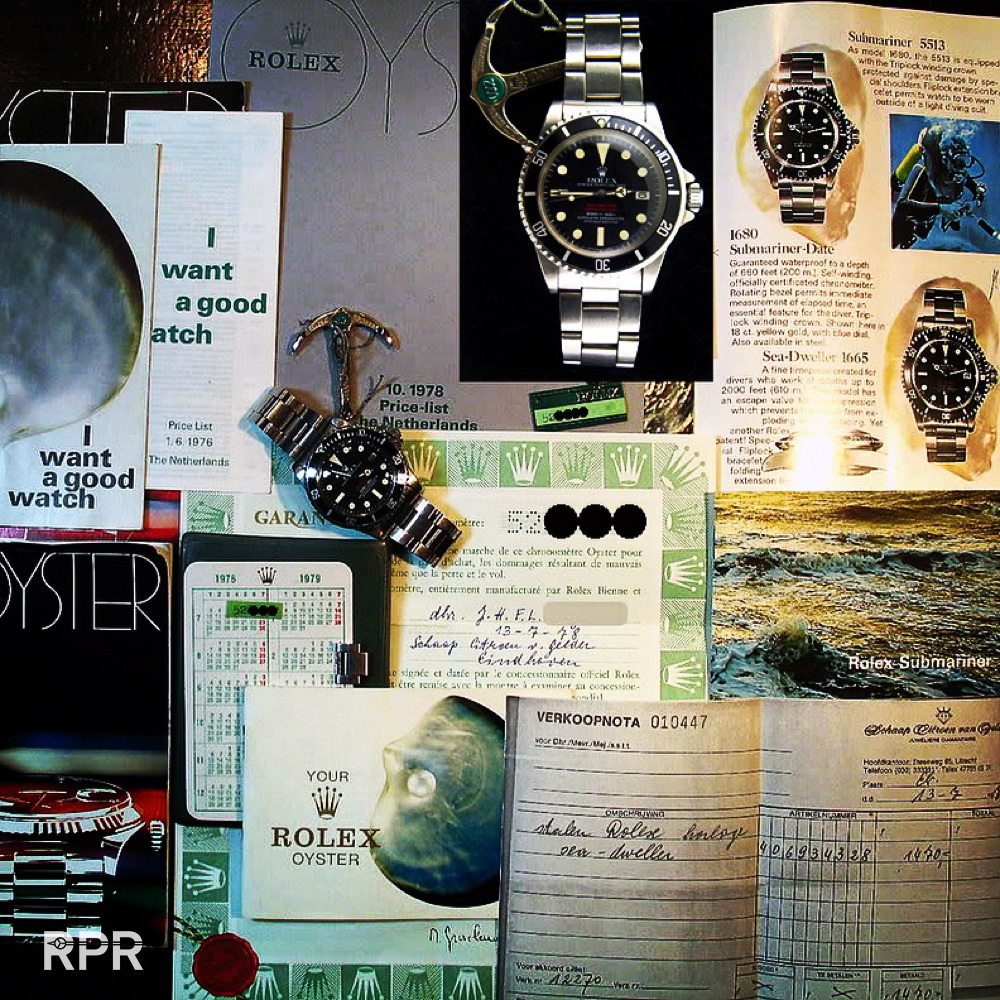

Nice original examples like the one above with all paperwork and provenance are certainly going up in price in 2016. It’s definitely not easy to find any farm fresh vintage Rolex, sports model in particular. The prices been asked are already 25-50% more then regular ones that have been “detailed” by professionals and missing the original papers and history so if you see one available, double check if everything is matching, then buy it.

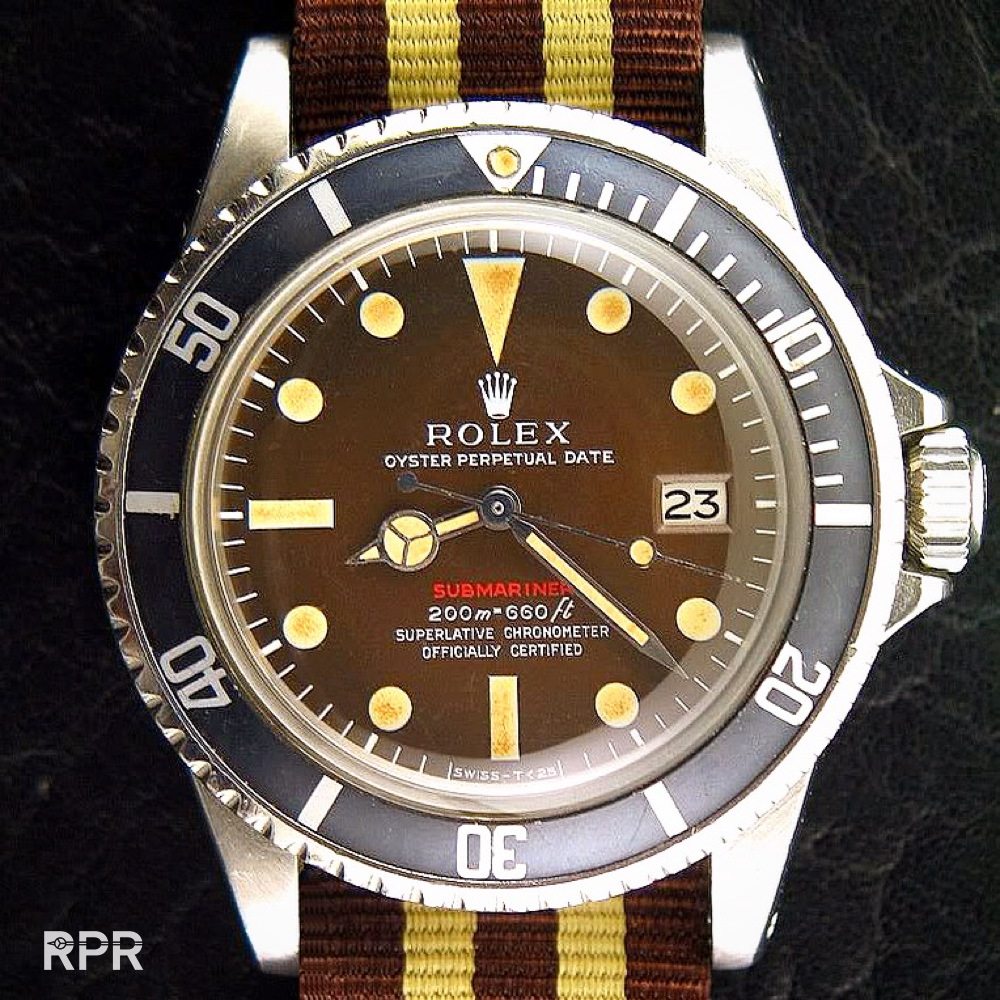

- Tropical GMT master Ref 1675 in below caramel color are spectacular looking wit the all brown bezel insert, very elegant indeed!

Any “Minute Track” Sports Rolex has got the must have status now. As the market is moving on to more affordable 70-is matt dial versions the Pre 1963 sports models: Submariner, GMT Master, Explorer, actually every model with a close minute track will be seen as historical important. Meaning highly collectable for the near future.

- Below you see a 1962 GMT master Ref 1675 with closed minute track…

- Even the smaller sized early Explorer. Every sporty minute track will be a must have for future vintage Rolex collectors.

With collecting you often see that when one model or reference goes up in price this much it’s becoming unreachable for most collectors to be able to buy, the second best options will go up as well within 1-2 years. The mythical 200 meter waterproof Rolex Big Crown has international attention now and thats not only because James Bond was wearing one, no it’s because when you start informing yourself into the vintage world of Rolex, you will automatically like these über Submariner from the early days.

Now that regular “swiss” dialed Big Crowns are being sold for easily 100K and if it’s nicely glossy having a red triangle insert even more then this, the time has come that collectors move to the second best option, the 100 meter Small Crowns. Just as impressive when you first look at it but in detail less corpulent, less fat, less domed, less big crown as the crown size isn’t the giant 8 mm but instead 6 and 7mm. My advise is to go out and hunt for a great small crown as prices have gone up from nice examples being around 18-25K for many years gone up to easily 50-60K and more for pristine ones…

- The 200 M Big Crown Ref 6538 on the left and 100M small crown Ref 6536/1 on the right..

- 2 x Ref 5508 small crown Submariner. The left one is a 1962 “exclamation mark” and the right one a 4 line SCOC…

- Almost 60 years after the first purchase, it’s rare to find the a small crown with original papers and service records…

- Next is a rare early version, a mix of small and big crown, the Red Depth Ref 6536, having the typical early long mercedes hour hand, the early non dash bezel insert and the depth rating added in numbers only: 100/330. Inside Rolex they speak about a prototype. Note the 6 o’clock index being a bit greenish, showing the wearer in the dark quickly where below is..

Then the regular glossy 5513’s will still go up even further then they already did. We can compared them with old Porsches, everybody likes them, the domed crystal, the gilt dial, faded bezels is still one of best looking vintage Rolex in general. Prices went from 10 to 20K and since 2014 going up to 50K and way more for pristine examples.

- Perfect tropical (faded from black to a warm brown) are on their way to 100K mark and more….

Next, the “Blueberry” GMT bezel thats popping up everywhere since like 1 year and we will see even more in 2016. The look is so cool everybody like it and prices for regular GMT’s with all blue bezel gone up from 10-15K to 25-30K there where loose bezels are being sold for 10K and more, it still pays out to put one on a 5 million Radial. If Rolex has ever made them or contracted these, we still can’t proof because there’s no actual picture from a Rolex catalogue where these are being published. Rumor is they where produced in Italia when Rolex ordered them, question of course remains how many did Rolex buy and how many the bezel manufacture made or still is making. We do know that on middle east UAE some have been serviced and maybe then, they chanced the bezel to all blue and the 24 hour red hand to all red.

- An UAE GMT Master Ref 1675 with original all blue bezel..

Any vintage Rolex with convincing provenance and paperwork are still a must to have, even after the “rolex warranty-gate” when we saw that papers where added to existing watches by using blank certificates and old punch machine to reconstruct the papers, it’s a must to have more then just the watch. Collecting is off course looking for perfection in every detail how small it is, it’s important but knowing the necessary “story” behind it is what makes it a great Rolex.

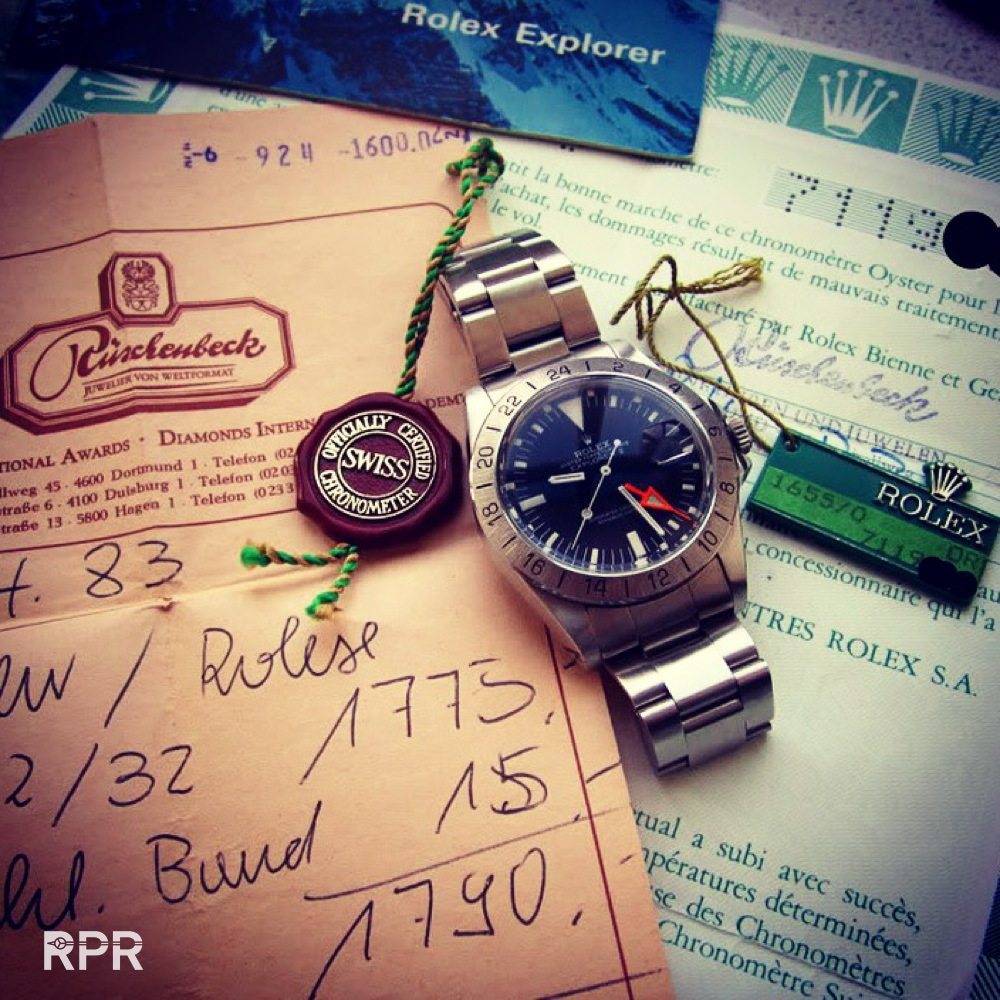

- Explorer II – Ref 1655 with fixed bezel, with all Rolex papers, booklets, receipts and hangtags as shown below, is still very undervalued compared to the sporty models with turning bezels…

For 2016 I think

the GMT Masters will continue to grow in price. A rare matte Radial Ref 1675 is already trading for 10-12K which is easily 50 % more then 2 years ago. Then, a

ny Big Crown with nice looking glossy dial will continue to rise as good 2 line BC hit easily 150K already. Now we see that the regular Daytona has jumped up in price from 20-25 to 35-50, the next move will be that priced at 10-15K, grows to 20-25, as we see happening with Small Crown Submariner for instance. Long time these where in a region around 15K but now we see great quality also sell for 50 or more.

- With collecting the focus generally is on something thats rare and a nice dress watch from Rolex is rare to see thus any original „precision” will go up, specially the big size 38mm ones.

- The big Precisions are rare and so impressive due to their 38 mm size, the black Pre Daytona Ref 6238 below here almost looks small next to it…

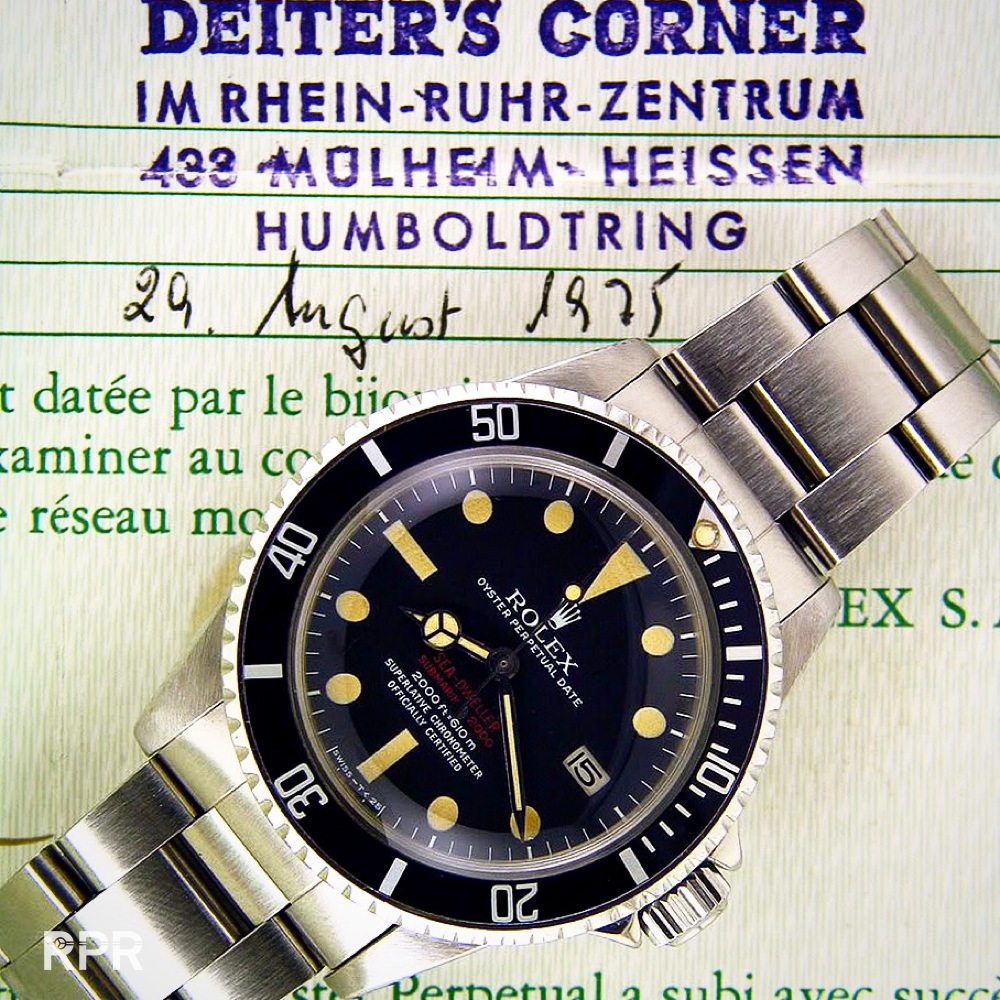

I also noticed that fine White Sea-Dweller and of course the more rare Double Red versions are slowly going up in price. The huge trend for maxi ref 5513’s, Red Submariners have pushed their prices to a level they start reaching their big brother, the Sea-Dweller. And therefor the Ref 1665 is enjoying new interest. After many years remaining on the same price level, while the rare MK1 and MK2’s lowered in price due to the fact collectors found out there weren’t as rare as being said, prices in 2015 starts to climb again.

The same reverse trend I noticed with Comex Submariners. Some 5 years ago their prices where higher then now being achieved in the market, also due to the fact that many thought the Comex Subs where more rare and less available then now. Somehow the “hype”is a bit over for now. Same can be said about the regular Military Submariner’s Ref 5513, the much more rare double ref’s and unique reference 5517 are a different story, these have shown a steady grow in value due to their rarity been found in full spec modification…

- The Comex Rolex Submariners and Sea Dwellers. For 2016 I don’t think we’ll see a mayor price shift, they will stay the same or decrease a little as those being priced in the market I find to be too aggressive compared to their rarity…

For many european collectors it’s extra hard to find anything to add to their collection as the dollar compared to the euro has become very expensive making it impossible to buy in the US. America has always been an important Rolex outlet, many great watches are still been found over there. As the most important sales country from the 1950-ies upwards Rolex started to develop special models for the US, like the Milgauss flat bezel, the Daytona and later the Red Submariner “feet first” instead of “meter first”.

- MK2 Double Red Sea-Dweller in still having it’s original black dial with cherry red printing, which is rare as most are faded to brown…

- An Double Red Rolex MK3 Sea Dweller..

- 2x Double Red MK3 Sea Dweller, actually one of the more rare versions you see less then the MK2 but then the MK2 is the only Seadweller that changes color from black to brown to become tropical.

- White “Rail- Dial” Seadweller op top and MK2 with tropical dial on the left and MK4 Double Red on the right..

- Last MK4 Double Red Rolex Sea Dweller produced with “Box & Papers”..

- The “Great White” Seadweller, here as rare “Rail Dial” is a great vintage Rolex that will give you lots of fun wearing it on a daily basis. This particular version has just been made for a short period only, the dial came from the Stern Company, nowadays owner of Patek Philippe.

And nice tropicals Red Subs and Sea Dweller are on the wish list of almost every vintage Rolex collector. If you find a honest examples, don’t think too long. Here a nice chocolate thin case ref 1665 MK2 that sell easily for 50K and more now…

- Or this Red Submariner “Meter First” Ref 1680 which are like 30K without and 40K with papers…

Then I think for those that are already having an interesting collection, the earlier Monobloc Oyster Chronograph is a great option to consider in 2016. This year you should go for one as my gut feeling tells me prices are going to increase rapidly. Not only due to the many asian collector that have become vintage Rolex collectors having the perfect wrist for this smaller sized Monobloc Ref 3525 but also seasoned collectors begin to appreciate this important Rolex model. The stainless steel ones with white dials sell for around 50-75K, the black dials are more rare and sell for the double. Rarest are the gold ones which we see go sky high already at auctions.

- Handfull of Rolex Monobloc ref 3525’s, Geneva’s first Oyster Chronograph of which some have interesting POW history..

- Extremely elegant & perfect in all over design, double signed and sold by Beyer in Zurich is this Rolex Ref 3525 from 1943…

Now everything collectable is shifting up every newbie entering the vintage Rolex market is looking for a great affordable vintage Rolex. One of those that are still undervalued are the early and rare steel Datejust and then specially those having a texture dial are real hidden gems in my opinion.

- Below you see a rare black with gold & silver printed text ref 6305 & a white brother with red Datejust and depth rating: 50M = 165 FT radium waffle texture dials…

Handfull of early Datejust. If you find one in the market, go for it before others will do! I expect prices to go up in 2016 as these elegant Rolex comes from the same era as the iconic Big Crowns, Padellone, Stelline etc and having the date this early has long been overlooked as being special. The waffle dial is the cherry on the cake making this regular model look extravagant.

Then in top segment almost everything has gone up in price except

the Killy alias Datocompax (

here’s a overview of all models made by Rolex at an earlier RPR report) This model has not totally been neglected. We’ve seen some exceptional results up to 500K for a stainless steel Killy in great condition but all over this model is somehow not as sexy as a Rolex Daytona. When I started to collect many years ago the Killy was way out of my league, specially in stainless steel with rarely seen steel index, the cost was at least twice that of a Oyster Newman, which fetch now easily 200-300K. The “Killy” on the other hand hasn’t gone up this steep as the “Cosmograph” did, although its one of the most complicated Rolex ever made. I therefor think that this iconic model will gain interest in 2016. Maybe even because there’s a lack of a better deal, the Killy will be attractive for collectors.

- Stainless steel mono bloc cased Rolex Killy Ref 6036 with steel pyramid index and handset. The cream colored dial, the lowered silver index and blue date printed in the track around the dial are just magical to me. This all in Rolex Oyster case is just perfect.

My conclusion so far for 2016 and what is coming afterwards:

The vintage watch market is changing as we noticed already in 2015 when you analyze all auction sales results. The collectors are getting much more mature and don’t spend their money if it’s not worth it, even if they are better of spending it then keeping it on their bank account, where they don’t get any return nor does it bring them any pleasure. No dumbheads are (online) buying anything stupid anymore at auction. Those watches been offered with a defect are being noticed and don’t find a buyer anymore, something that happened in the past due to the greedy mood of many new collectors being frustrated that there was nothing interesting offered in the market or they where to late and in some cases didn’t even got a chance to buy it.

Logically now there’re many buyers in all price segments, the market is changing for it’s own good. After years of incredible growth it’s coming back to what we should call normality. A steady growth of like 10 percent or more every year is more logic to happen in the current market then price jumps of 20-50% on hot models like we saw last 2 years. (Some Longines, Movado, Heuer and specially Universal Chronographs in the meantime have been gone up 2-300% due to the heavy interest for vintage Rolex and Patek Philippe) But as long as the sellers demands are reasonable, the sales upwards will continue in 2016.

Vintage Rolex that can be bought any day of the week, need to be priced more realistically to find a buyer. All offers on Chrono24 for instance are too high. We see thousands of Rolex over there being priced to high not moving at all. This is what is going to happen in 2016, the regular quality whatever the reference will go down like 10-20% and the top quality whatever the reference will continue to increase in value. The most sought after iconic models will still be hot and sell if the estimate is not much higher then in 2015. The market needs time to get used to the price levels that Paul Newman’s, Big Crowns, Milgauss 6541’s or any special delivery Oman, UAE, Tiffany etc. achieve now. These won’t get any cheaper. Compared to like 5 years ago the value of a 100K Rolex has become 200-250K. The unique examples will break record prices in 2016 so we will continue to see 1 million plus vintage Rolex been sold at auction and in private sales.

As long as you buy quality and really enjoy it, you’re save, also for 2016!! 😉

Cheers,

Philipp