My Rolex Geneva Auction Report May 2018

The main reason why I visited the Geneva watch auctions was the Daytona Ultimatum sale, which became off course a huge succes. Why do I add off course, because behind the scene in the open market we have seen Daytona’s already sell for millions of euro’s so it was not really a surprise to see the white gold Daytona “Unicorn” hit 5 million hammer, a more interesting question is, shouldn’t 10 million be the correct price for this so far unique Daytona??…

Prior the sale I aimed with my prediction at the high end, 30 million but at the end of this special theme sale the total was $ 22 million or € 18.5 million, an average of $700K each, not bad for a Valjoux based Chronograph with rare Singer dials, because yes, in almost all cases except the white gold Daytona, the huge premium that has been paid because of the dial. Thats why this auction was so important, it showed the evolution of dial design so perfectly. We have come from far trying to explain why certain dials only belong in certain cases and this brings us to an point I like to explain better. The Italians have invented the art of collecting vintage Daytona. Specially a hardcore group of enthusiast in Rome of with Pucci is the center of knowledge. They have studied each and every important detail and summarized all info in the huge Ultimate Daytona Bible that changed the view towards the cosmograph completely….

Over sudden the Daytona could compete with an perpetual calendar Patek Phillips and many called me crazy that back then I kept saying that one day a simple steel Rolex chrono will outbid a complicated PPC. Something I like to explain my readers is that those early adopter didn’t see any problem changing a daytona dial from one case to a better one. As Rolex themselves started sending out loose Paul Newman dials to please their dealers sitting on unsaleable Daytona stock, it’s not the Italians that invented swapping but it was Rolex who fed the market with the idea that a better, more updated dial can go from one case to another without destroying its value. No in contrair they became more valuable. It was due to the knowledge of these collectors / dealers obtained that it became a challenge to have the perfect Daytona. Something aficionado’s absolutely dislike when collecting Submariner. With Subs for instance its very important the dial was born in the case because the dials where different, glossy, gilt, radium luminous and cases had bevels and had to be withstand weatherproofness, which all together gives it an all unique matching patina that when it’s perfectly original, it multiplies the price…

Daytona’s buyer’s look mainly at the condition of the dial, if one lume dot is missing it could easily cost you 100K on a Oyster Newman. This difference of this perception between a Daytona collector and a Submariner, GMT, Milgauss etc collector I like to emphasize, Daytona is like Day Date, if the dial wasn’t born in there its not a crime, like with the white gold Unicorn that was found originally with a reprinted dial. It’s due to the experience and knowledge of the buyer, in this legend John Goldberger, that he decided to add a ‘logic’ dial, a sigma – with white gold indexed. The 5 million result for charity of children in need is a divine gesture I immensely respect, John / Auro is my hero no matter what!

Back to the Ultimatum sale, is it dramatic that I predicted 30 million and all 32 Daytona’s sold for 22.5 million? Off course not, it’s all a matter with what you compare the result with, not with the$832 million the Rockefeller sale did in a couple of days. My mistake was that I compared it with the expectation of the 2013 Daytona theme sale when 50 lots sold for Chf 13 million, which was then little less then €10 million, an average of 200K. Back then I was flabbergasted from lot number 1, an underline Daytona which I didn’t buy a couple of months prior the 2013 sale for €70K which sold for Chf 270K. All 50 lots performed extremely well compared to their realistic estimates. Back then I was stuck at my chair, something I wasn’t this time. Now I saw Aurel Bacs was looking for bids, although everybody is happy with the results, this auction wasn’t Bacs best performance. He seemed a bit helpless, his jokes needed to overshadow the fact that the action was gone, sometimes the room was completely dead and all action came only from anonymous written and commission bids, internet and phone bids and 2 lots where having a third party insurance, something we see with financing the billion dollars art market. It’s become very hard to find out who bought what nowadays….

The results for vintage Rolex this weekend where exceptional and I was very please to see that not only at Phillips top dollar was paid for rare Rolex but also at Sotheby’s where the ultra tropical Newman sold close to Chf 1 million. At Antiquorum a minty non luminous gold GMT master hit over 300K. Christie’s wasn’t that impressive this time and it showed that when quality isn’t great, buyers won’t pick up vintage Rolex just because they have a high estimate. The Mk1 Paul Newman did not sell but then the estimate of 600-1.2 million was extremely high for this quality. The market has developed and after the many years of reporting of the most important auctions, watch shows here at RPR for you, the many collectors meetings I visited and the thousands of discussions I’ve had all together going online available for you to read and learn about it, passion helped collectors want to spend big money for a great vintage Rolex….

We have come to a point where most off us are not able to buy a Newman anymore. Actually I’m kind of happy my expectations where to high, the last couple of years the daytona prices have gone up so fast, almost too fast for collectors to adsorb. At the airport back home I spoke with a prominent Daytona collector analyzing the results and both of us came to the conclusion that the market did not totally understand the exceptional condition that had come for sale. It takes years of intensive upgrading to reach this level of perfection and our conclusion was that current buyers mainly look at it as an unique investment and are less passionate about the fact about the rarity. The fact it took the consigner sometimes many years to find this grail Rolex is the reason why the prices are so high. Intensively I have traveled around the world, bought my share of ultra rare Daytona’s to be able to see these rare offers that where hidden in private collections. It will be extremely hard to beat this line up of exceptional Daytona’s in any future sale…

It was great seeing you all again so massively, i’ve really had a great time meeting up with you! Find below selection of pictures I like to share with you. In the next days i will add some more c comments to all the pictures below so tune in later this week top see my full report, for now I’m off to enjoy a sunny day. If you want to see all the watch auction results check them out over here of the total of Chf 73.8 million

- Phillips Daytona Ultimatum sold for Chf 22 million

- Phillips Geneva 7 sold for Chf 23 million

- Sothebys sold for CHF 6,588,500,=

- Christies sold for CHF 12,241,750,=

- Antiquorum sold for CHF 9.99 million

I found another unicorn in the old city of Geneva… 😉

The Neandertal sold at Chf 3 million… Not bad for a design study that never went into production!

The Arabic sold for Chf 1.9 million and the Mk1 Oyster Paul Newman for Chf 750.000,=

Chf 1.9 million….

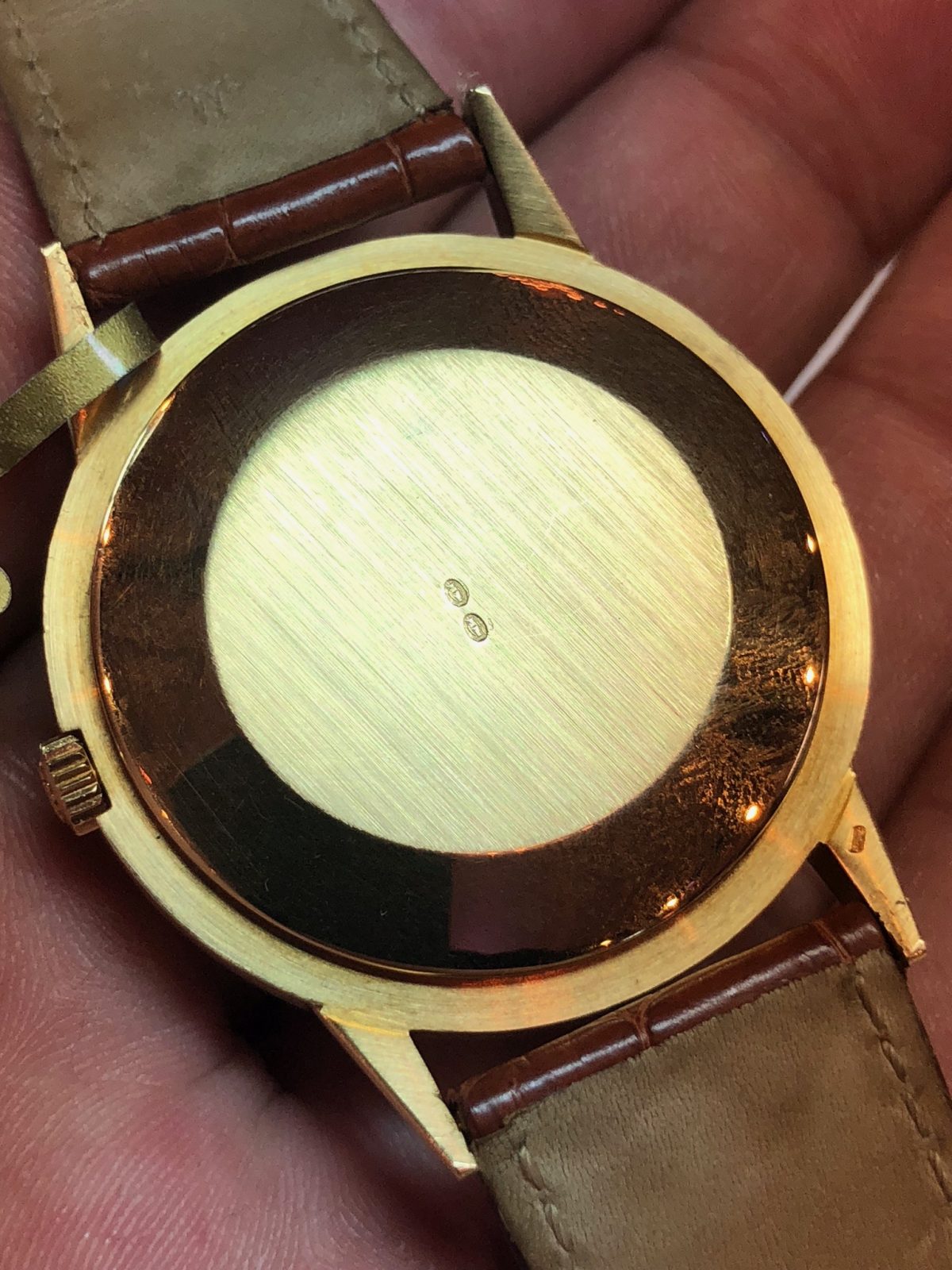

The arabic Daytona has an Aprey stamp on the back, somehow nobody notice besides new director of Phillips London Thomas Crown Affair, Jimmy Cosmo or let us just call him James Marks. Nice guy and very sharp eye for detail, something good can happen in London now he joined the stable !

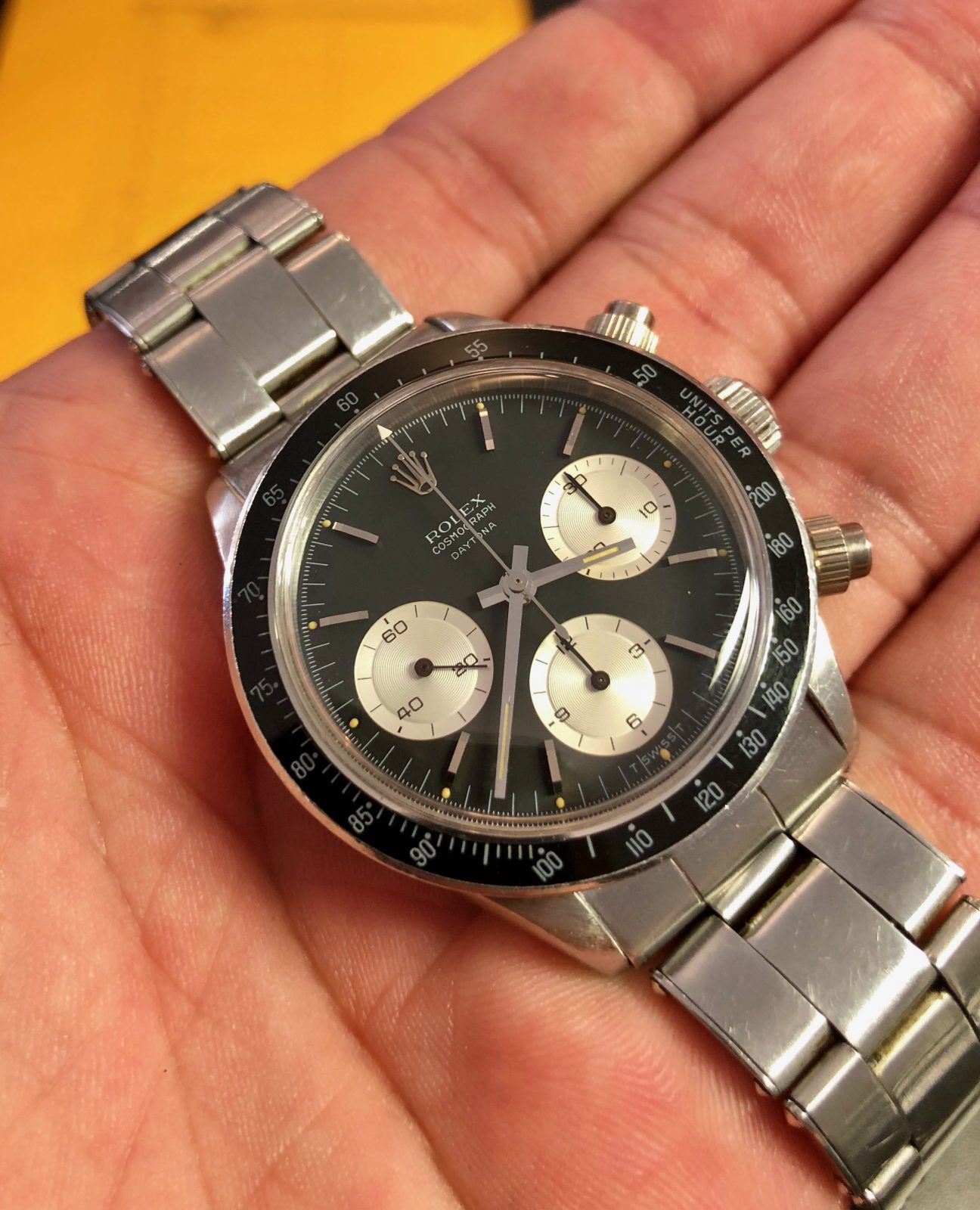

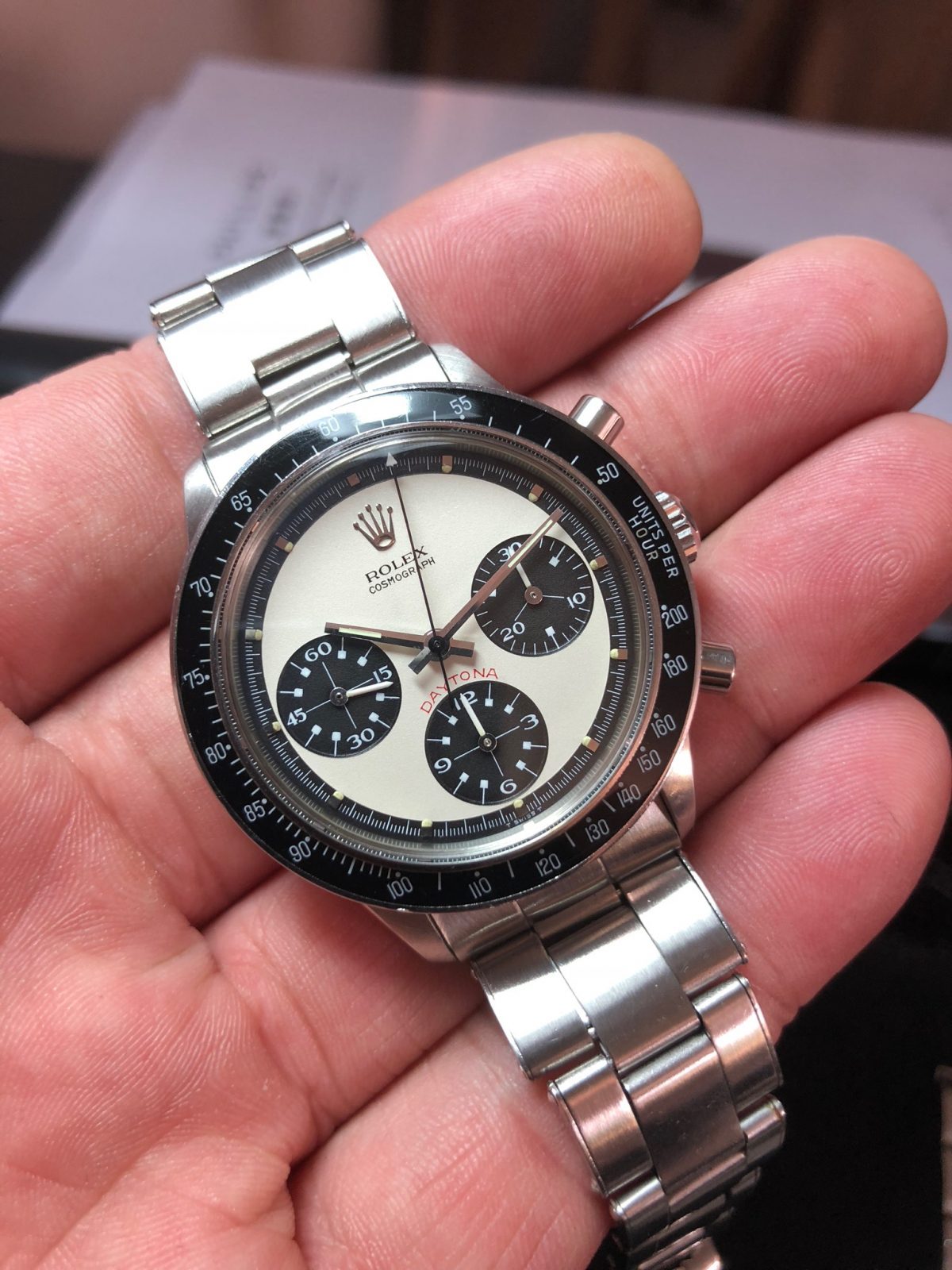

This is what 750K looks like…. Lets break it down for you to understand how much money this is. A minty regular 6263 would cost you 100-150K so basically the new owner paid 600-650K for the dial only, amazing!

This incredible RCO with great provenance ended top at Chf 1.665.000,=, I thought it would hit 2 million specially…

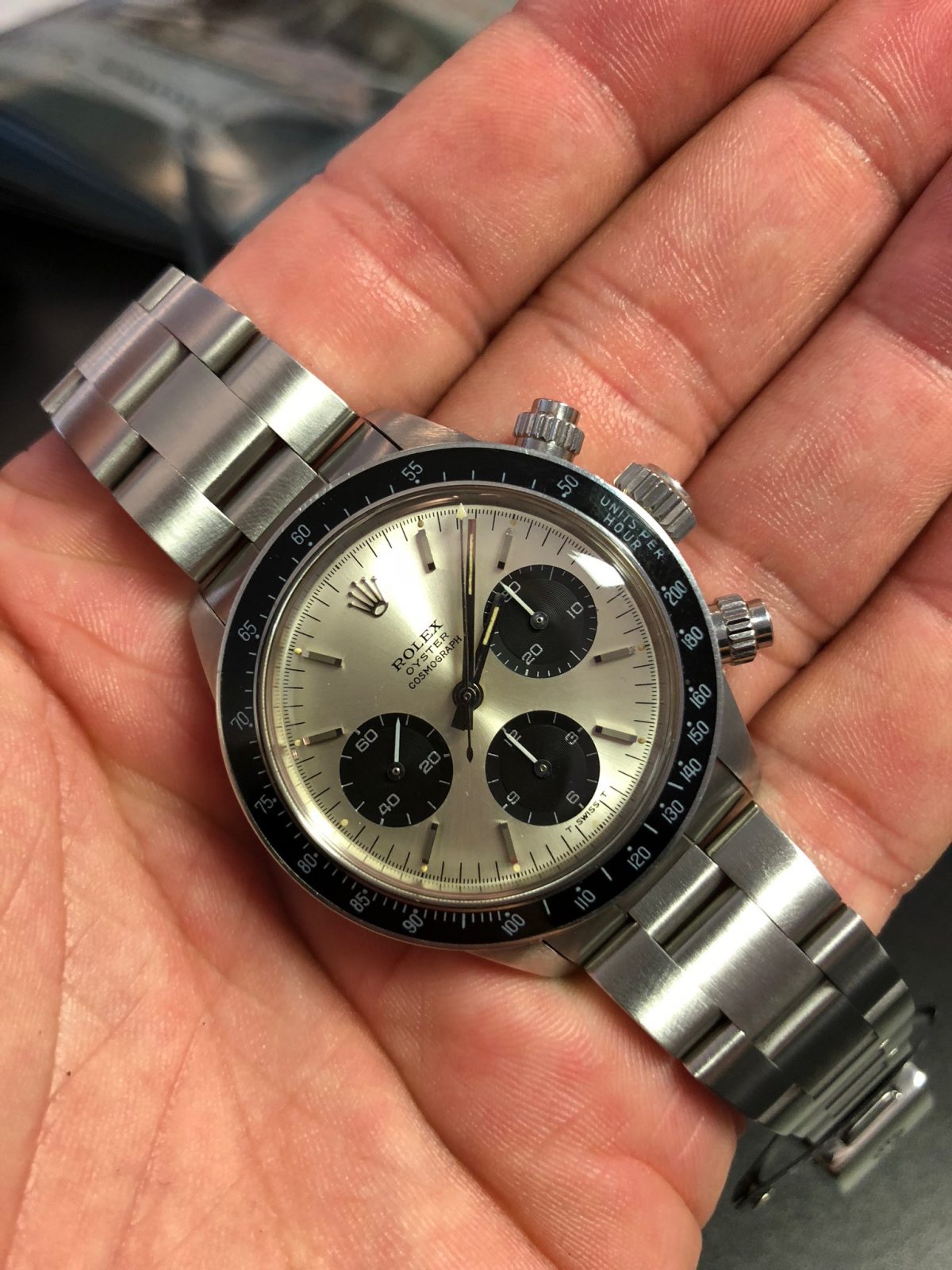

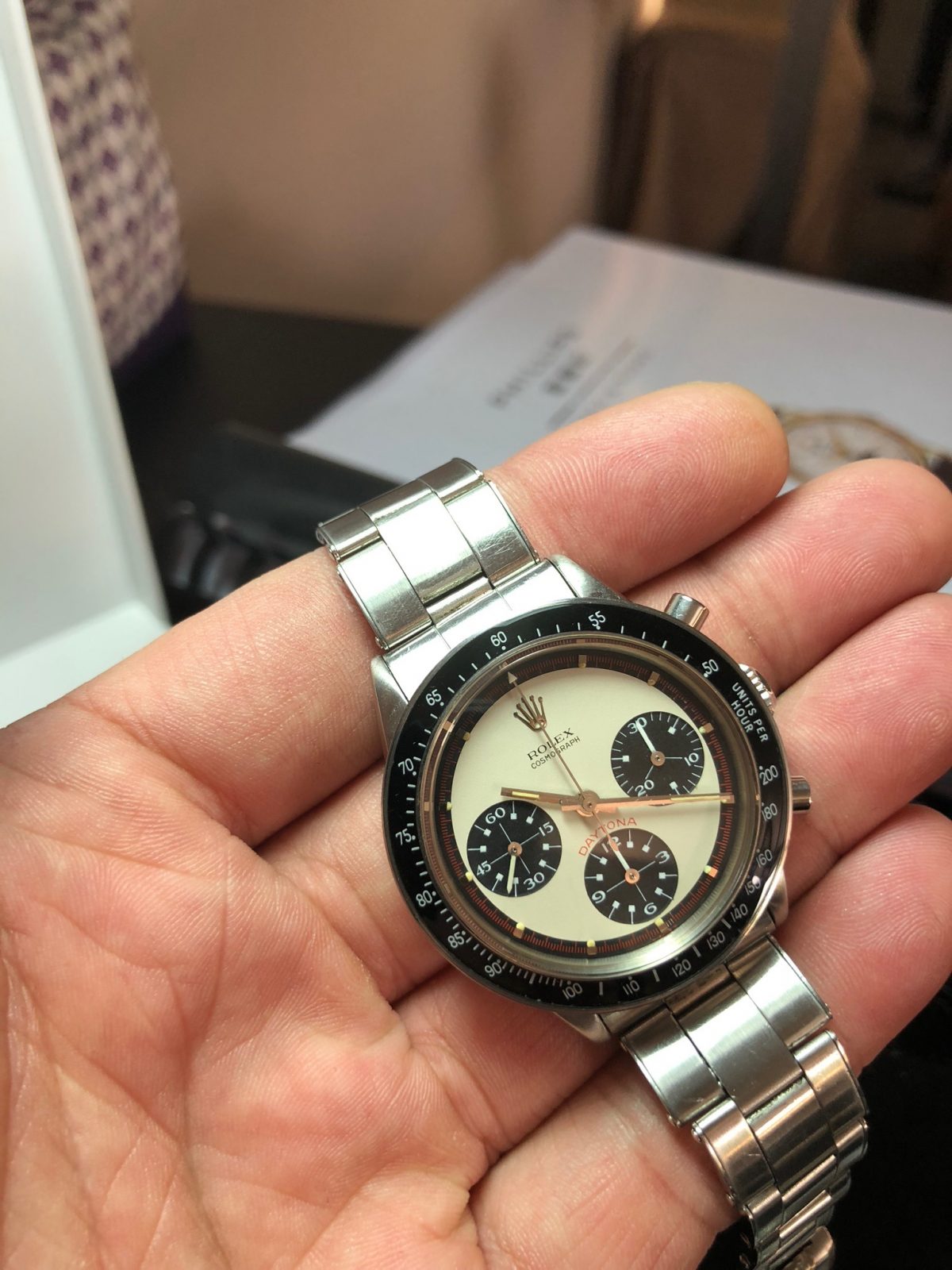

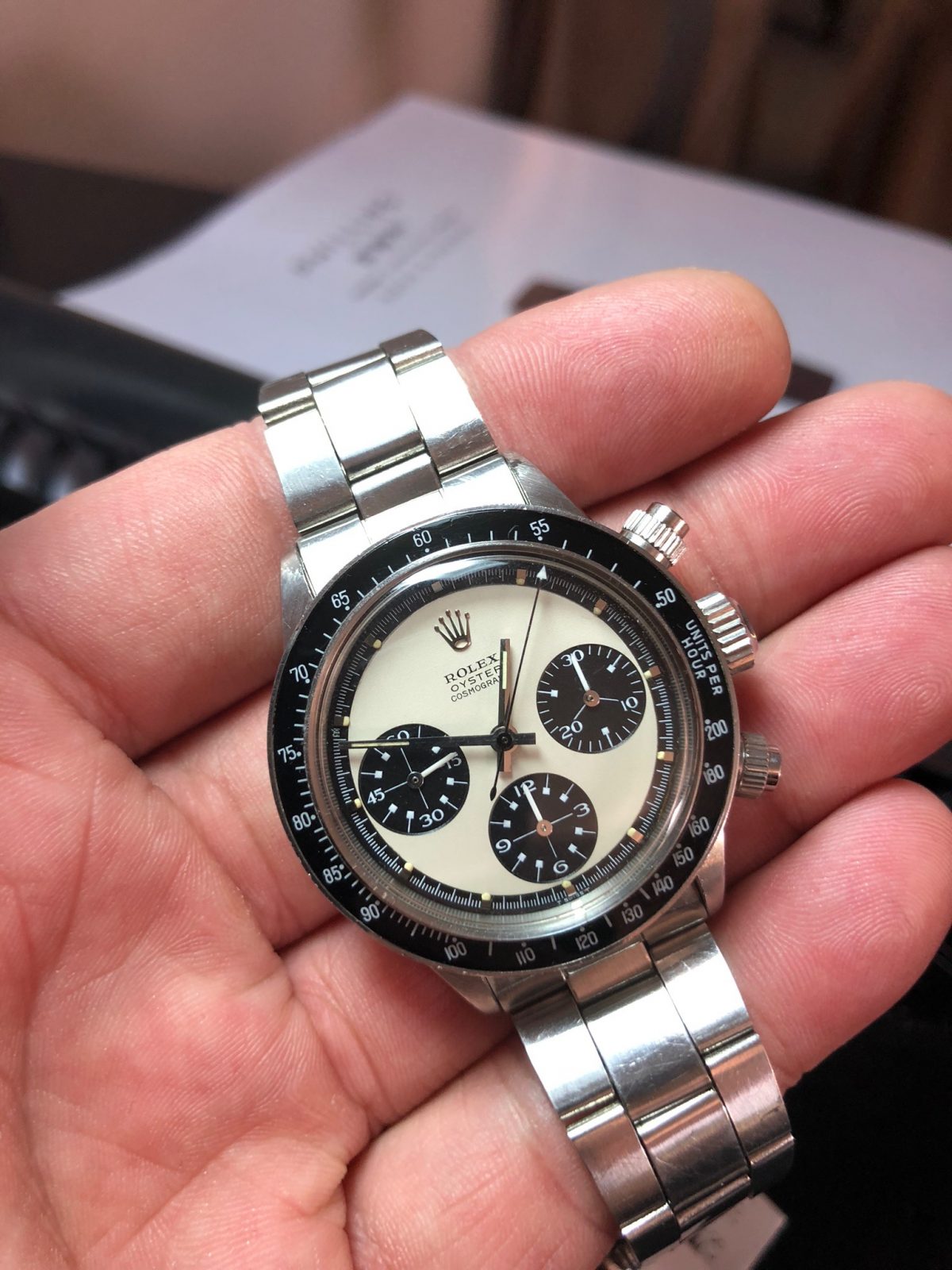

A n exceptional crisp Rolex Ref 6239 Paul Newman sold for almost CHF 1 million,= and shows again that the key to fine collecting is condition…

The UAE sold for Chf 325K…

This gold Ref 6241 Paul Newman hit Chf 516.500,=..

Chf 106.250,=

Chf 162.500,=

Bon apetit…

Milgauss flat US bezel version Ref 6541…

Chf 606.500,=

Close to 1 million, Chf 912.500,=

Chf 262.500,=

Chf 318.500,=

Chf 187.500,=

Chf 143.750,=

FAP Chf 137.500,=

Perpetual Daytona are definitely the next serious trend, Porceleine CHf 187.500,=

Tropical Chf 218.750,=

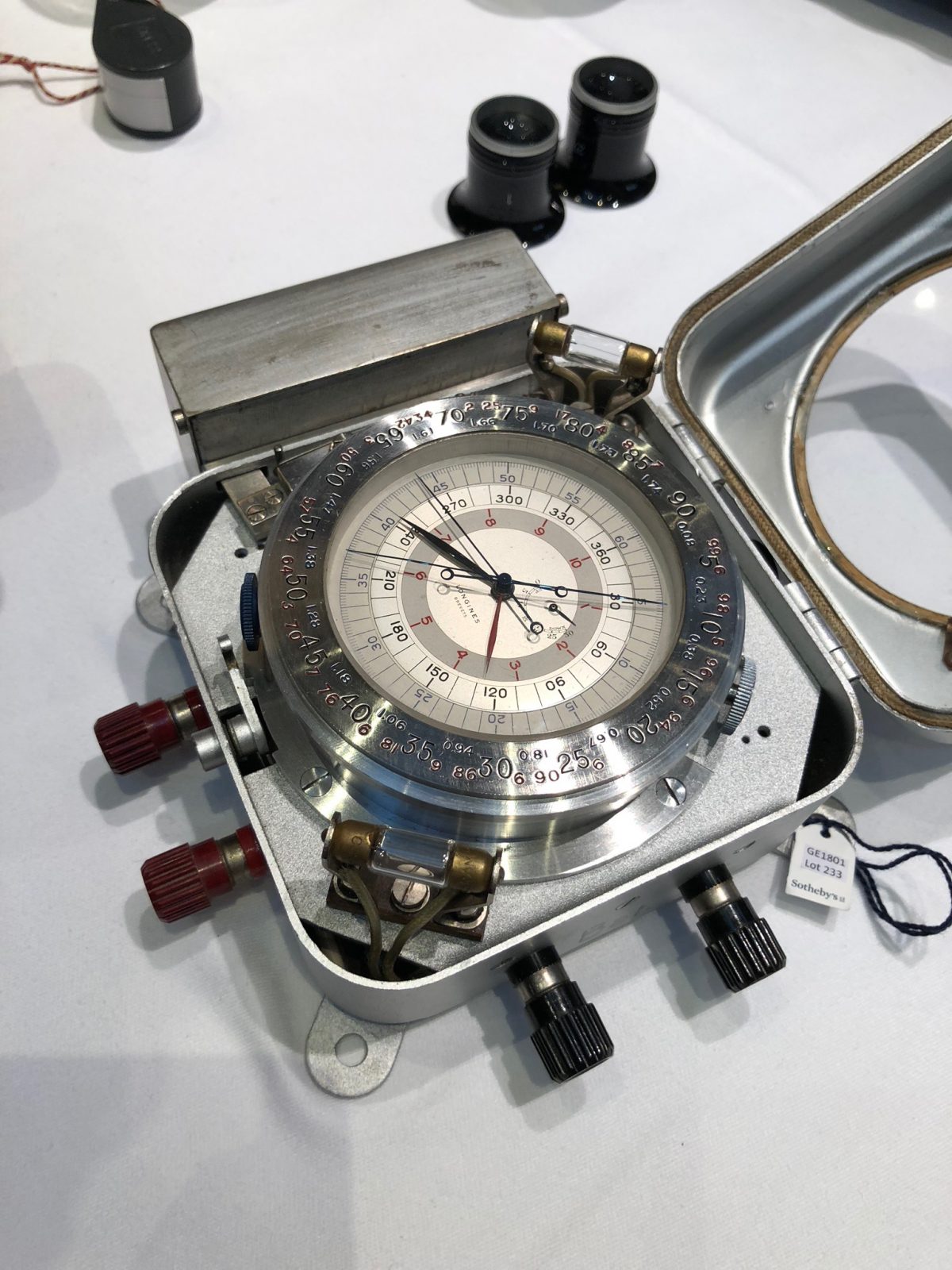

24 Le Mans Chf 60.000,=

The luminous looks like chewing gum…no good and then you won’t find any buyers…

Or if the estimate is way to high compared from what you get….the market will not adopt and got also unsold.

Somebody bought himself a 45K expensive joke, imho…

The orange paint wasn’t;t dry yet haha…

Above a stunning first owner MK1 Oyster Paul Newman and below one of the best Subs,ariner coming to market for a long time

Then one of the greatest Rolex Submariner will come for sale at Christies NY that has been found in the wild, estimated $ 500K – $ 1 million I wouldn’t be surprised its will hit the high estimate!…

When brothers meet after many years….

Vacheron Minute repeater…

Looks closely….yes that the exception to an exciting rule, it’s not always Oyster Sotto but also Oyster Middle ( East 😉

At Phillips we will see an sale with 60 % of vintage, the highest percentage they have had so far, lets see how the market picks it up in 2 weeks…

Non helium valve sea dweller ref 1665 coming for sale at Phillips Hong Kong…

with an high estimate of $ 500.000 – 1 million…